🎉

Volmex's BVIV and EVIV Indices are now available on Bloomberg Terminal, the world's leading provider of financial market data with tickers BVIV and EVIV-VOL. View now!

🎉The world’s first crypto volatility indices

BVIV (Bitcoin Volmex Implied Volatility) and EVIV (Ethereum Volmex Implied Volatility) Indices

Ecosystem of Indices and Linked Tradable Products

Implied Volatility Indices

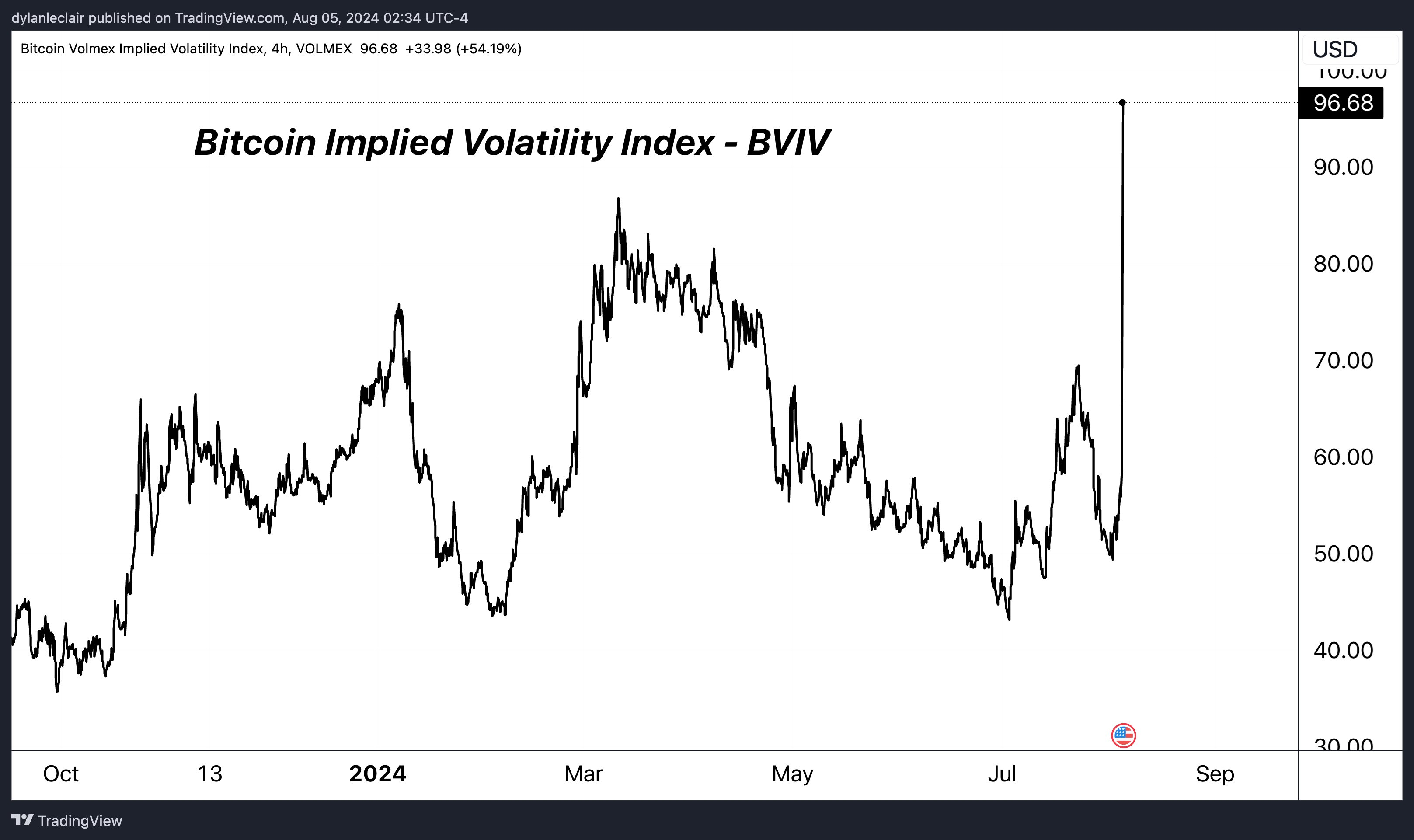

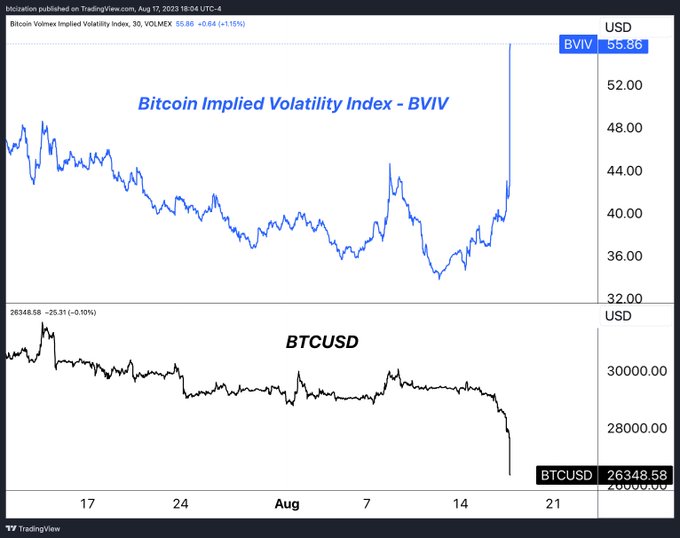

Use the BVIV and EVIV Indices as a fear gauge for the market.

Perpetual Futures

Trade BVIV and EVIV perpetual futures on Bitfinex and Gains today, and soon more!

Indicators

Volmex offers novel indices including Volmex Realized Volatility Indices, Volmex Spot-Volatility Correlation Indices, and soon more.

Use cases

Hedging

BVIV and EVIV are gems that behave differently than an average market portfolio of crypto assets! Volmex implied volatility indices move up when the market goes down, and reduces the losses in times of FUD. Add it to your portfolio now!

↳ Learn more

Speculation

BVIV and EVIV are simply the volatility! Volmex implied indices are highly persistent and have a tendency to revert to its mean value. Perfect asset to speculate on!

↳ Learn more

Market Indicator

Volmex indices are the fear gauge of the market! EVIV and BVIV capture not only crucial information of the current market state, but also what the market thinks about what’s next. Use Volmex indices to create trading strategies!

↳ Learn more

Join the Volmex Community

Available on

And

Trade BVIV and EVIV perpetual contracts on Bitfinex, one of the first and most liquid crypto exchanges

Bitfinex

gTrade

The world's first Bitcoin and Ethereum volatility indices available on TradingView

Search for "Bitcoin Implied" and BVIV is the first result ✨

Our Partners

We partner with the best in the crypto industry.

Backed by leading crypto investors

See how others are using Volmex Indices

Use the EVIV and BVIV Indices to your advantage in your trading, investing, and analysis.

Latest Research

10-07-2025

Bitcoin and Ethereum Options Summary

October came after large Deribit September expiries, with IBIT options' open interest surpassing that of Deribit BTC options for the first time. As of October 6 end-of-day, IBIT-to-Deribit open interest (OI) reached 95%, while ETHA-to-Deribit OI hit a historical high of 71%.

↳ Read

08-26-2025

BTC & ETH Options Positioning Before September Fed Meeting

Both onshore (IBIT/ETHA) and offshore (Deribit) markets are heavily concentrated in expiries immediately after the Fed’s Sep 17 meeting, this is a clear sign that traders are bracing for volatility.

↳ Read

09-12-2025

BTC & ETH Options Market Update

While BTC ETF options imply a need for hedging the downside risk (i.e. low deltas), ETH options are showing a clear bullish tendency, with a possibility of treasuries and institutions positioning for upside.

↳ Read

07-24-2025

BTC Options Market Update

IBIT's higher average delta and lower average strike imply more ATM and ITM option exposure, while Deribit skews toward out-of-the-money calls. As for the expiries, both set of options have similar maturity profiles.

↳ Read